billings montana sales tax rate

Billings MT Sales Tax Rate. A full list of locations in Montana can be found below.

Best State In America Montana Whose Tax System Is The Fairest Of Them All The Washington Post

Combined tax rate 0 Local rates are set by the county city or other taxing district.

. There are three main stages in taxing property ie setting mill rates appraising property market worth and taking in payments. Within Billings there are around 13 zip codes with the most populous zip code being 59102. The tax applies to charges paid for the use of.

An alternative sales tax rate of 10 applies in the tax region Billings which appertains to zip code 74630. Remember that zip code boundaries dont always match up with political boundaries like Billings. The Billings Sales Tax is collected by the merchant on all qualifying sales made within Billings.

The December 2020 total. Montana has no state sales tax and allows local governments to collect a local option. Under state law the government of Billings public schools and thousands of other special districts are given authority to appraise real property market value set tax rates and collect the tax.

The most populous zip code in Montana is 59901. The 785 sales tax rate in Billings consists of 4225 Missouri state sales tax 175 Christian County sales tax and 1875 Billings tax. The sales tax rate does not vary based on location.

The Montana MT state sales tax rate is. The sales tax rate does not vary based on zip code. Montana has no sales tax.

Avalara provides supported pre-built integration. The sales tax rate does not vary based on zip code. If you need access to a database of all.

The Billings Montana sales tax is NA the same as the Montana state sales tax. Ad Manage sales tax calculations and exemption compliance without leaving your ERP. The Billings Oklahoma sales tax rate of 6 applies in the zip code 74630.

The Billings sales tax rate is NA. The most populous location in Montana is Billings. There is no applicable special tax.

There are approximately 473 people living in the Billings area. The December 2020 total. Click any locality for a full breakdown of local property taxes or visit our Montana sales tax calculator to lookup local rates by zip code.

Tax rates last updated in July 2022. While many other states allow counties and other localities to collect a local option sales tax Montana does not permit local sales taxes to be collected. The current total local sales tax rate in Billings MO is 6975.

Montana has 0 cities counties and special districts that collect a local sales tax in addition to the Montana state sales tax. 4214101 ARM through 4214112 ARM and a 3 lodging facility sales tax see 15-68-101 MCA through 15-68-820 MCA for a combined 7 lodging facility sales and use tax. Bozeman MT Sales Tax Rate.

The average cumulative sales tax rate in Billings Montana is 0. This includes the rates on the state county city and special levels. There is no applicable special tax.

2022 Montana Sales Tax By County. 4 rows The current total local sales tax rate in Billings MT is 0000. Sales Tax Breakdown For Montana.

Billings is located within Yellowstone County Montana. Montana Sales Use Tax Information. The sales tax rate does not vary based on county.

Sales tax region name.

District Of Columbia Sales Tax Small Business Guide Truic

Taxes Fees Montana Department Of Revenue

File Sales Tax By County Webp Wikimedia Commons

Metaverse Platform Second Life To Pass On Tax Burden To Users Nftgators

North Dakota Income Tax Calculator Nd Income Tax Rate Community Tax

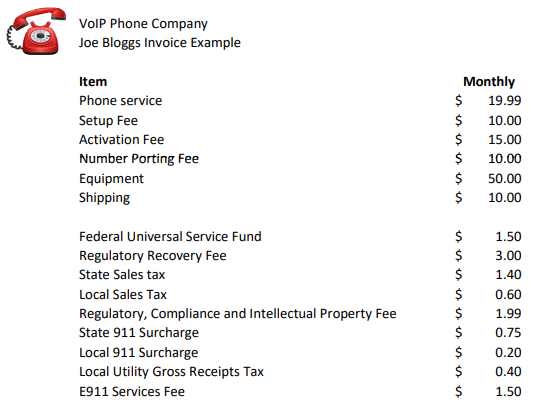

Voip Pricing Taxes And Regulatory Fees Explained

North Dakota Income Tax Calculator Nd Income Tax Rate Community Tax

Missouri Sales Tax Rates By City County 2022

Billings Oklahoma S Sales Tax Rate Is 6

More Montana Counties Look To Add Local Sales Tax On Marijuana Products Ypr

North Dakota Sales Tax Calculator Reverse Sales Dremployee

Ron Drzewucki S Bullion Sales Tax Series State By State Pt 3

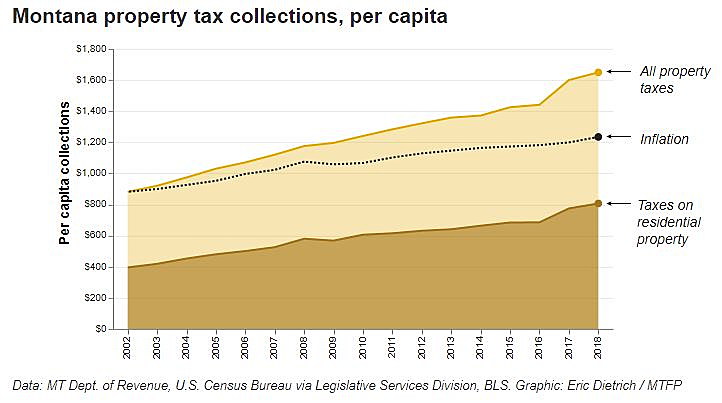

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Montana Sales Tax Rates By City County 2022

North Dakota Income Tax Calculator Nd Income Tax Rate Community Tax